Most Schuylkill County property owners have now received their 2025 Final Reassessment Value Notification—and for some, the numbers are triggering confusion, frustration, and fear of losing their homes.

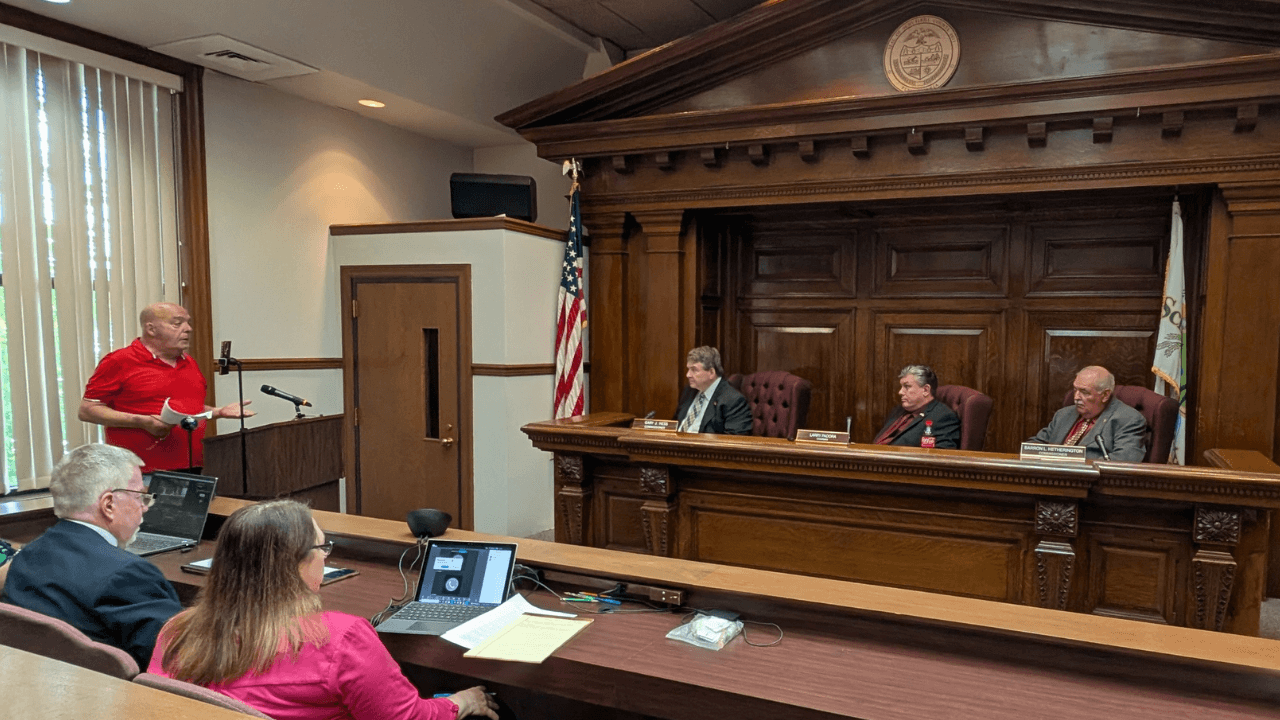

Most of Wednesday’s Schuylkill County Commissioners meeting was spent hearing from residents who voiced fears and frustrations about rising property taxes caused by the ongoing reassessment.

The reassessment appeals period begins next month. By year’s end, Schuylkill County will set a new millage rate based on the updated property values. Municipalities will follow suit, and school districts are expected to adjust their rates next summer.

At Wednesday’s meeting, Commissioners heard from residents who fear they’re going to lose their homes due to the reassessment because of the new tax bill they’re expecting to receive.

“I work with senior citizens,” Steve Moyer, of Pottsville, said. “They are scared. They are upset. They don’t know how they’re going to stay in their house.”

This reassessment is the first one in Schuylkill County since the mid-1990s. The gap between reassessments has resulted in massive spikes in property values between then and now.

That, alone, is causing some grief among many property owners in Schuylkill County.

While some are actually seeing their property taxes reduced, others are not as fortunate and some claim they’re going to be forced to pay as much as three times what they’ve been paying in property taxes next year.

“My taxes went up three times,” Sue Reed, of Pottsville, told Commissioners. “I don’t even get that much in Social Security. How do you expect me to pay these taxes when my one month of Social Security doesn’t even cover it? So, one month, I can’t eat. I can’t pay my bills. I pay my taxes instead? Three times is a lot of money for a senior citizen. It’s disgusting.”

While Commissioners did not address anyone’s specific claims about their personal tax situation, they did express frustrations with the reassessment laws and their ability to collect revenues from other sources besides a person’s physical property.

As they have since the beginning of the process, Commissioners say state laws opened Schuylkill and other counties to the lawsuit that resulted in the reassessment.

They also expressed a desire to see legislators in Harrisburg pass a law that mandates more frequent reassessments to prevent the sort of sticker shock that many property owners in Schuylkill County are currently experiencing.

Commissioner Larry Padora, as he’s said in the past, also wished that the state would allow counties to implement other taxes, like an additional sales tax, to reduce the burden on property owners.

Subscribe to Coal Region Canary

Get email updates from Coal Region Canary by becoming a subscriber today. Just enter your email address below to get started!Support Coal Region Canary

Like our reporting and want to support truly local news in Schuylkill County? Your small donations help. For as little as $5, your contribution will allow us to cover more news that directly affects you. Consider donating today by hitting the big yellow button below ...

Steven A Knudsen

July 10, 2025 at 1:55 pm

Mine has gone up about 80% from 2025. My question is simple. Why do they need so much more money in 2026 to run the government? And, if the budget is the same for 2026, how do I get my name on the “Friends and Family” list to pay lower taxes?

TPG

July 12, 2025 at 10:12 am

Don’t worry. Argall is going to eliminate property taxes.😂😂😂

Ken

July 12, 2025 at 11:25 am

Good job guys keep up the good work