Schuylkill County property owners should discard the Homestead/Farmstead Exclusion applications they received in the last day or two.

That notice comes from Schuylkill County Chief Tax Assessor Crissy Zimmerman. Zimmerman tells The Canary that a critical printing error is on each form. And because of that error, the form is invalid.

A new form is being printed and will be mailed to Schuylkill County property owners as soon as possible.

On Friday, Zimmerman said her office was flooded with phone calls from confused property owners who had just received their Homestead/Farmstead Exclusion form in the mail.

Critical Error

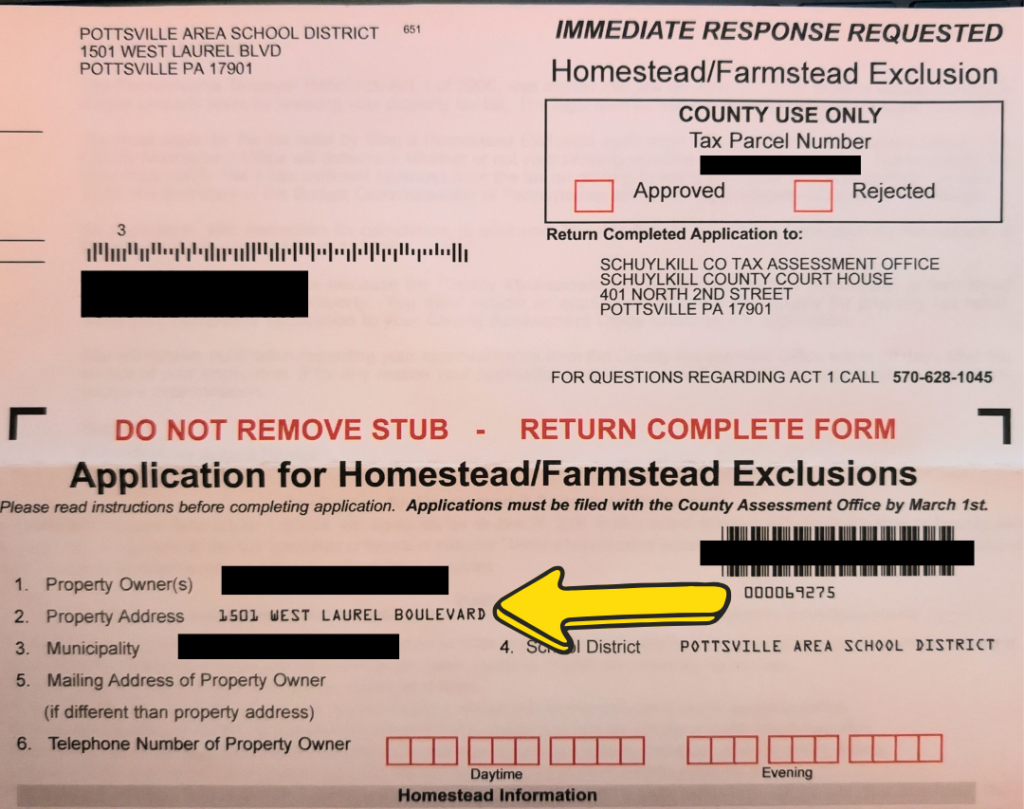

The error is on the Property Address line. Instead of having the property’s address, the mailing address of the property’s school district is printed.

See the image below showing the error on the form:

Zimmerman says a third-party firm, BerkOne, hired by Schuylkill Intermediate Unit 29 is responsible for printing and mailing the Homestead/Farmstead Exclusion applications.

The applications arrive in a property owner’s mail in a white envelope. The property’s school district is visible at the return mailing address, but all Homestead/Farmstead Exclusion applications, once completed, are to be sent to the Schuylkill County Tax Assessment Office.

Zimmerman said these mailers should have also gone out in the mail several weeks ago but is unsure what caused the delay.

According to Dr. Anthony Serafini, executive director at Schuylkill IU29, “IU29 provided all required information to BerkOne on time, and the proofs approved prior to printing were accurate.”

Serafini adds, “BerkOne has acknowledge the error and confirmed that IU29 and the regional school districts will not incur any expenses related to reprinting or mailing corrected forms.”

What Schuylkill County Property Owners Should Do

Zimmerman advises Schuylkill County property owners to discard the Homestead/Farmstead exclusion applications they just received in the mail.

A new application with the correct information on it is being printed and mailed.

Once that new, corrected application is printed and mailed, property owners wishing to apply for the Homestead/Farmstead Exclusion should fill it out and send to the Tax Assessment Office at 401 N. 2nd St, Pottsville.

The deadline for submitting the new, corrected form once it’s received, will remain March 1. Zimmerman said the state sets that deadline, so she has no flexibility in changing it, regardless of the error.

👉 The Canary will work with the Tax Assessment Office to notify property owners when the new applications are mailed to provide that information to the public.

What is the Homestead/Farmstead Exclusion?

The Homestead/Farmstead Exclusion grants qualifying property owners some tax relief.

A property counts as a homestead if it’s the primary domicile of the owner. A farmstead consists of the non-exempt structures on an owner-occupied farm of at least ten contiguous acres that are primarily used for commercial agricultural production, storage, or livestock housing.

The Homestead/Farmstead exclusion is a dollar amount that’s deducted from the assessed value of a qualifying property. So, if a property is assessed at $100,000 and qualifies as a Homestead or Farmstead, the owner would pay the tax on the assessed value of the property, less the Exclusion rate.

Each school district sets its own Homestead/Farmstead Exclusion rate.

In 2025, Schuylkill County Commissioners also approved a $20,000 Homestead/Farmstead Exclusion for property owners on their County tax.

NOTE: This article was updated from its original version to include comments from Serafini.

Subscribe to Coal Region Canary

Get email updates from Coal Region Canary by becoming a subscriber today. Just enter your email address below to get started!Support Coal Region Canary

Like our reporting and want to support truly local news in Schuylkill County? Your small donations help. For as little as $5, your contribution will allow us to cover more news that directly affects you. Consider donating today by hitting the big yellow button below ...