A key step in the completion of the Schuylkill County Property Tax Reassessment is complete.

On Thursday, County Commissioners OK’d a resolution that instructs Chief Assessor Crissy Zimmerman to use the new property values from the ongoing countywide reassessment to create the official 2026 property tax list, or assessment roll.

That roll is what determines how much each property is worth for tax purposes. Those values will be used when Commissioners set a new millage rate when they approve their revenue-neutral budget for 2026.

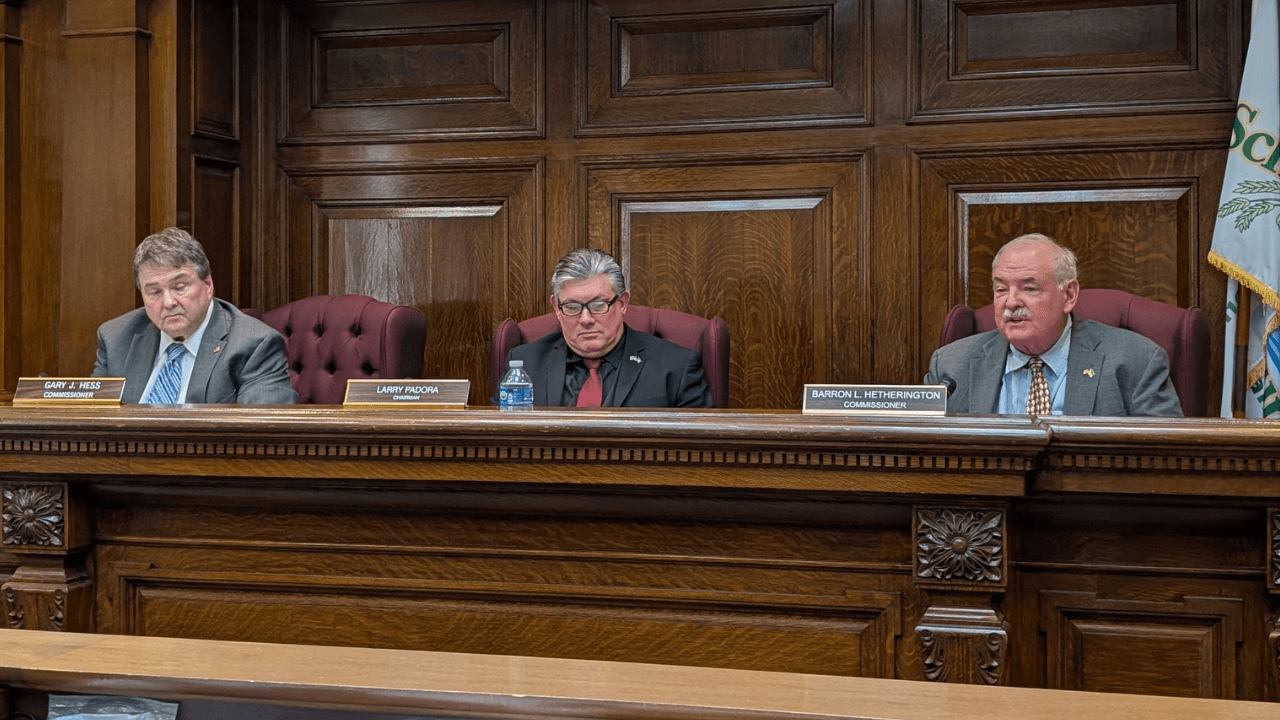

However, the vote to give Zimmerman the go-ahead to certify the new property values determined through the reassessment was not unanimous. Chairman Larry Padora cast a lone dissenting vote while Commissioners Boots Hetherington and Gary Hess approved.

Padora explained that he knows his No vote on Thursday will be interpreted as symbolic. He promised not to certify the results of the reassessment when he was campaigning for Commissioner back in 2023. And he had to assume his fellow Commissioners would vote to OK the Tax Assessment office certifying the results of the reassessment.

He said his main issue is not with how the reassessment was conducted or even the results of it but rather how the state handles the reassessment process. Padora actually praised the Zimmerman, her staff, the auxiliary appeals boards, and the company that conducted the reassessment, Vision Government Solutions.

“I do not want my ‘No’ vote to be interpreted as a negative reflection on our County’s reassessment process,” he said.

Padora said he believes the reassessment process went smoothly and its results are fair. He also was happy to be able to implement the first county homestead exemption, which deducts $20,000 off taxed value of a property owner’s primary residence.

Hess and Hetherington again said they were forced into conducting the reassessment through a court order but believe the process was conducted fairly and professionally.

Hess said the initial decision to stop fighting a lawsuit that prompted the order to conduct the first countywide reassessment in 30 years was not an easy one.

“In this position, you are elected to make the tough decisions and over my tenure here, there have been many,” he said.

“We recognize that not everyone will be pleased with the ultimate outcome but he citizens of Schuylkill County should be satisfied that the process was handled well,” Hetherington said.

Hess echoed earlier comments and praised the work of everyone who was part of the reassessment process.

What’s Next?

Now that the Commissioners have authorized the Tax Assessment Office to prepare the new assessment roll for 2026, a new millage rate will be set next year. The millage will be approved by the Commissioners when they approve next year’s spending plan over the next few weeks.

That millage rate must be revenue-neutral — meaning the County can’t collect a penny more in property taxes than it did in 2025, despite the higher property values from the reassessment.

However, once the the County approves its revenue-neutral 2026 millage rate, the Commissioners can then vote to increase property taxes by up to 10%. State law caps how much the County and municipalities can increase taxes in the year of new reassessment values going into effect.

The Commissioners also voted Thursday to allow the County’s Tax Assessment office to send every municipality and school district a worksheet that shows them how property values changed in their jurisdiction.

The worksheets will show boards in those areas how to calculate their new millage rates for 2026 based on the new property values. Municipalities will need to calculate that rate so they can pass their budgets before the end of this year.

Subscribe to Coal Region Canary

Get email updates from Coal Region Canary by becoming a subscriber today. Just enter your email address below to get started!Support Coal Region Canary

Like our reporting and want to support truly local news in Schuylkill County? Your small donations help. For as little as $5, your contribution will allow us to cover more news that directly affects you. Consider donating today by hitting the big yellow button below ...

Marguerite F Coreia

November 7, 2025 at 6:46 pm

This reassessment was anything but fair. The home comparison was not fair as far as the sale costs of similiar homes in the area. What bank is going to mortgage a home valued at $200,000 but is taxed at $370,000? But if these commissioners know of any stupid person who is willing to buy a home like this, send them my way. We will see lots of properties up for sale. They need to hire people who actually know realestate. With all of the new construction going on in the county, elaborate homes and rentals, there was no need for this.