The president of Frackville’s Borough Council recently called out the more than a quarter-million dollars in delinquent real estate taxes.

Every month, Frackville includes a rundown of the delinquent real estate taxes owed to the Borough and typically, the report in which it’s included is read silently and approved without question.

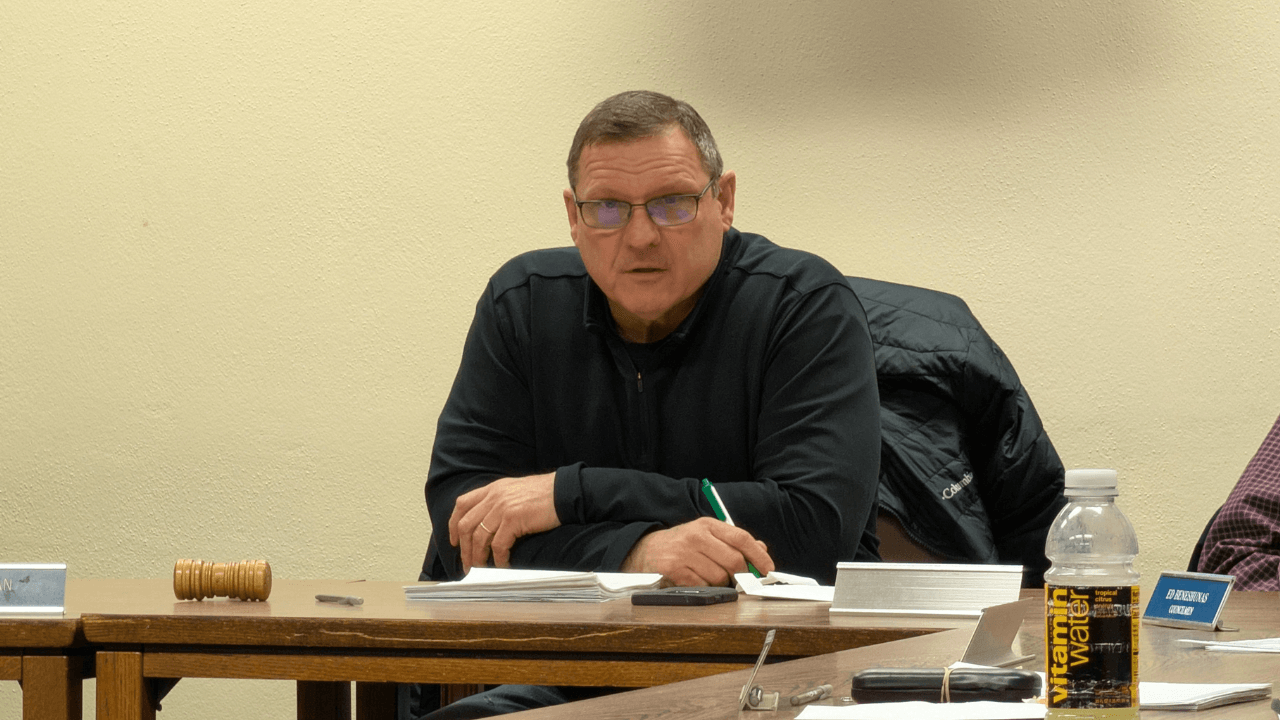

However, at the monthly meeting on Feb. 12, president Ron Jordan made special note of the amount of delinquent taxes.

Frackville says it’s owed $279,452.83 in delinquent payments. That dates back to 2012 but most of that money is from the last two years.

For 2025, Frackville says it’s owed $144,384.21 in property taxes. It’s more than $52,000 from 2024.

“If you think about what puts the borough in a little bit of a crimp,” Jordan said, “people holding on not paying their taxes. That’s over $200,000.”

Jordan added, “That kind of hurts everybody in this room on trying to get things done in the town.”

Here is a breakdown of the delinquent tax payments, as reported by Frackville Borough last week:

| Year | Delinquent Tax ($) |

|---|---|

| 2025 | 144,384.21 |

| 2024 | 52,572.05 |

| 2023 | 6,454.80 |

| 2022 | 6,548.21 |

| 2021 | 9,186.30 |

| 2020 | 10,173.44 |

| 2019 | 9,049.71 |

| 2018 | 8,560.43 |

| 2017 | 9,093.86 |

| 2016 | 8,526.30 |

| 2015 | 5,936.66 |

| 2014 | 4,329.83 |

| 2013 | 2,682.01 |

| 2012 | 1,955.02 |

| TOTAL | 279,452.83 |

Subscribe to Coal Region Canary

Get email updates from Coal Region Canary by becoming a subscriber today. Just enter your email address below to get started!Support Coal Region Canary

Like our reporting and want to support truly local news in Schuylkill County? Your small donations help. For as little as $5, your contribution will allow us to cover more news that directly affects you. Consider donating today by hitting the big yellow button below ...