Schuylkill County Commissioners urged anyone who believe there is an error in the reassessment valuation of their properties to file a formal appeal to try and get it right.

The property tax reassessment was once again the hot topic at this week’s Schuylkill County Commissioners Work Session meeting. Commissioners heard about a half-hour of concerns over the reassessment, specifically about the Final Value Assessments that were mailed to property owners earlier this month.

“If you don’t think it’s right, file a formal appeal,” Commissioners Chairman Larry Padora said. “If you think your value is wrong … if you don’t think you could sell your house today for that price, do an appeal.”

Padora even encouraged property owners who expect to see their taxes go down after the reassessment is completed to file an appeal if they believe their valuation is in error. It could, potentially, go down further if the valuation is too high.

“If you don’t think that’s right, no matter what your taxes are doing, file an appeal,” he said.

Schuylkill County property owners have until Aug. 11 to file a formal appeal and several hundred have already done so.

When the deadline to file an appeal passes, property owners will meet with auxiliary appeals boards to hear their cases for lowering their assessments and taxes.

County officials say property owners needn’t hire an attorney or even have a new appraisal done before their appeal hearing but they have a right to do so, of course.

Padora urged property owners to at least come to their hearing armed with as much information as possible.

“Take pictures around your property. If you got a bank loan or a HELOC or a recent appraisal in the last three years … take as much information as you possibly can to make the argument that your value is less,” he said.

Padora added that the auxiliary boards that are being assembled for reassessment appeals work a little differently than the traditional assessment appeals. He said they’ll consider information that the traditional board wouldn’t.

Any appraisal, however, must be completed prior to a property owner’s formal appeal hearing, County Treasurer Linda Yeich said Wednesday.

Appeals Settled Early

Schuylkill County Chief Tax Assessor Christine Zimmerman said Wednesday that her office – which is collecting and scheduling appeals – is currently reviewing the appeals applications.

If a property owner is filing an appeal because they believe the data collected on their property is incorrect, the Tax Assessment office is reaching out to them prior to the appeal hearing.

For example, if a property owner says their valuation is based on their having a finished basement but their basement isn’t actually finished, the Tax Assessment office will contact them to get it corrected.

In some cases, that change can affect the assessment value in the property owner’s favor. If it does change the valuation and the property owner is then satisfied, they will be asked to sign a release that withdraws their appeal request.

If it doesn’t satisfy the property owner completely, the new information will be added to the file and could help make the appeal hearing more efficient when it does happen.

Veteran and Senior Property Owners Contacted

Padora announced Wednesday that the County has sent information regarding the reassessment and the appeals process, specifically, to the Office of Senior Services and senior centers around Schuylkill County.

It has also reached out directly to military veterans organizations.

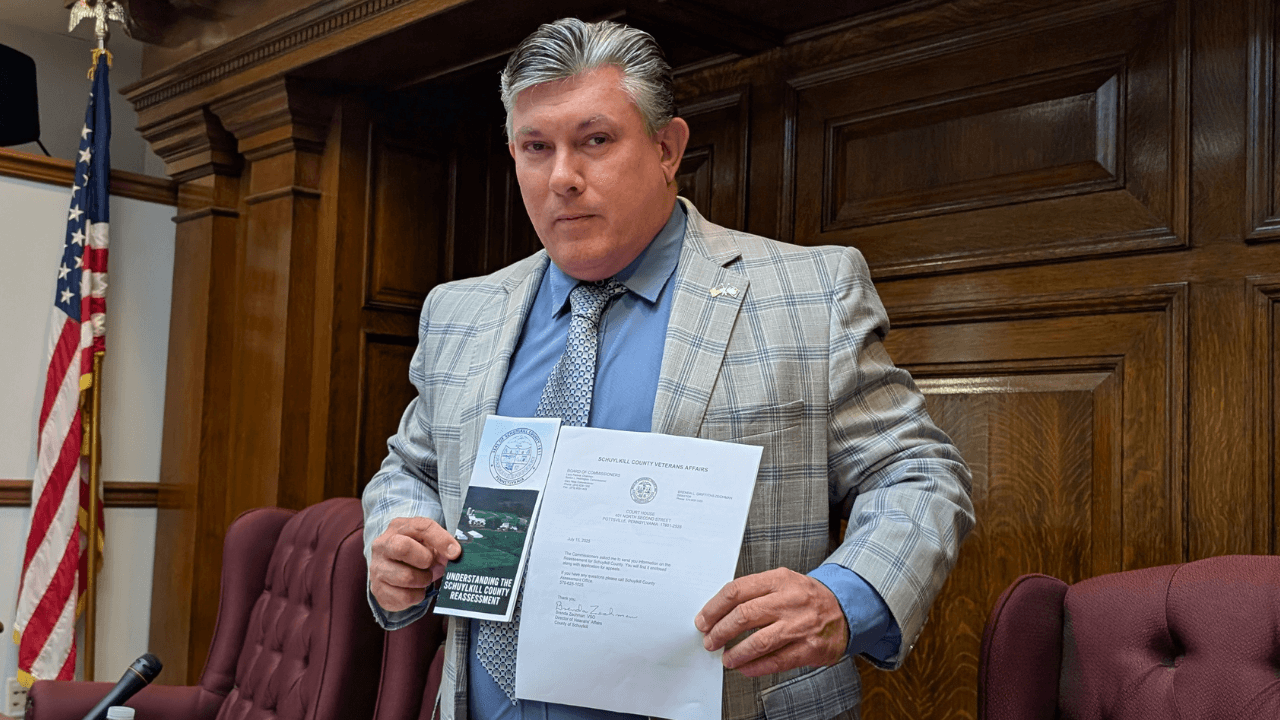

Padora said the County has provided all those locations with informational pamphlets on the reassessment, a letter explaining how to file an appeal, and appeals forms.

NO OTHER NEWS SOURCE HAS COVERED THE SCHUYLKILL COUNTY PROPERTY TAX REASSESSMENT AS EXTENSIVELY AS COAL REGION CANARY. TO SEE OUR FULL COVERAGE, CHECK OUT OUR PAGE BY FOLLOWING THIS LINK.

Subscribe to Coal Region Canary

Get email updates from Coal Region Canary by becoming a subscriber today. Just enter your email address below to get started!Support Coal Region Canary

Like our reporting and want to support truly local news in Schuylkill County? Your small donations help. For as little as $5, your contribution will allow us to cover more news that directly affects you. Consider donating today by hitting the big yellow button below ...

Carol Ruff

July 17, 2025 at 8:21 am

How do we get the for I have been going on the websites shown on the letters sent with new tax numbers and can not find it.

Fedupconseravtive

July 17, 2025 at 9:28 am

Thank you Canary for covering this.