Schuylkill County government officials have been ordered by the state to turn over records related to property upset sales.

The Pennsylvania Office of Open Records recently ruled in favor of an appeal by Jodie Forney.

Forney sought the following from Schuylkill County government through a formal Right to Know request but was denied at the local level:

- Details about each property sold at an upset sale, including its location, previous owner, the minimum bid price (based on owed delinquency), the final sale price, and the buyer’s identity.

- A financial breakdown for each property, including:

- The amount of delinquency owed to each of the three taxing authorities.

- The portion of the sale proceeds allocated to each of these authorities.

- Any surplus funds generated beyond the delinquent amount.

- The current status of these excess funds.

Additionally, the requester seeks the Bureau’s policies on notifying former property owners about their right to claim any surplus funds and the procedure for claiming such funds.

Last year, Forney asked for these records and the County responded by wanting to know what years Forney’s request covered.

Forney said she sought the records from 2021, 2022, and 2023.

On Dec. 12, 2023, the County said, as it does to most RTK requests, it needed a 30-day extension to respond to Forney’s request. Then, on Jan. 11 of this year, the County denied Forney’s request. The County said no such records existed … after first asking her what years she needed as part of her initial request.

So, Forney appealed to the state’s Office of Open Records (OOR).

In her appeal to the state, Forney said she believed the County was required to keep the records she requested. Further, she maintained that the County ignored the second part of her request, the copy of the County’s policy for notifying property owners that excess money from the upset sales was available to them.

On Jan. 25, Schuylkill County’s Open Records Officer Lois Lebo responded to the state by “reiterating claims for the County’s denial of the request.” Basically, the County told the state what it told Forney.

In granting the appeal and forcing the County to turn over the records, the state’s OOR said the County must actually prove that it looked for these records and that they don’t exist. To this point, the state believes Schuylkill County government officials did NOT perform that search or at least didn’t provide evidence of it.

“An agency must show, through detailed evidence submitted in good faith from individuals with knowledge of the agency’s records, that it has conducted a search reasonably calculated to uncover all relevant documents,” OOR Appeals Officer Damian J. DeStefano writes in his Final Determination ruling.

Lebo said that when she received the request, she forwarded it to Tax Claims Bureau Director Deborah Dasch. Dasch, Lebo says, is the one who asked for Forney to provide the specific years she sought as part of her initial request.

Dasch apparently told Lebo those records don’t exist and Lebo responded to Forney in that initial denial of her request. She said these are the reasons for the denial:

“1) There was no specific property or sale; and no document exists that lists the appropriation of funds for every parcel on every upset sale; and 2) there is no “policy” for notifications to property owners of any excess money. This is covered under the Real Estate Tax Sale Law.”

In his Final Determination, after weighing that response, of lack thereof, from the County, DeStefano writes:

“The County did not meet its burden that responsive records do not exist. The County does not explain the manner in which the search was conducted, the extent of the search, or what was searched in order to make the determination.

“Instead, the evidence only shows that the request was passed along to Dasch, and that the County ultimately denied it. The County failed to meet its burden that it does not possess, control or have custody of responsive records.”

And regarding Forney’s request for a copy of the County policy on notifying property owners of the excess upset sale funds to which they’re entitled, DeStefano adds:

“No evidence was provided that these records do not exist within the County’s possession, custody or control, nor was any evidence provided showing that responsive records are exempt from disclosure under the RTKL. The County failed to demonstrate that it conducted a search that was reasonably calculated to uncover all relevant documents responsive to the Request.”

Schuylkill County has 30 days (from March 13) to hand over the records to Forney or provide a sworn affidavit that the records don’t actually exist. This Final Determination from the OOR can be appealed through the Schuylkill County Court of Common Pleas.

RTK Trend Continues

This case is yet another example of Schuylkill County coming before the state’s Open Records office and losing.

Late last year, in one specific case, the state called Schuylkill County’s grasp on transparency “concerning” in dealing it another loss and ordering it to hand over requested records.

There have been two other recent OOR determinations. One, however did go in the County’s favor.

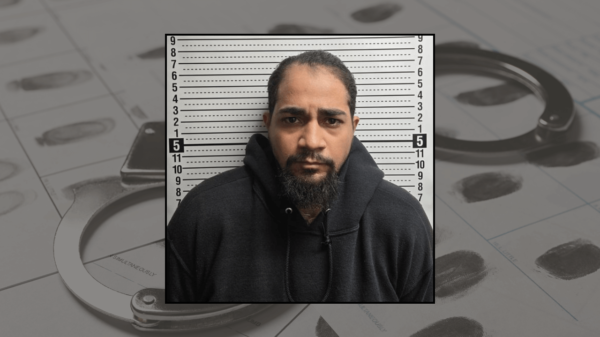

These decisions were based on RTK requests from the suspended Tax Claims employees who have been accused of misusing LexisNexis and allegedly exposing the personal security information of more than 9,000 people.

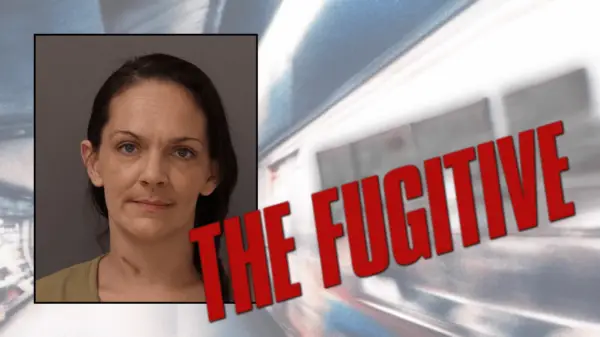

In the County’s lone win recently before OOR, Denise McGinley-Gerchak was denied her request to get the names of people who took advantage of the County’s offer to give them Experian credit monitoring after she supposedly exposed their personal data.

In upholding the County’s denial of that request, the state said the Courthouse was not obligated to provide that information because Experian was dealing with those individuals on its own. The County is merely paying the bills from Experian.

And although third-party vendors like Experian are subject to RTK laws when it comes to government functions, the state said credit monitoring was not a government function.

Another RTK appeal with OOR involved a request from the other Tax Claims employees who’s been suspended more than 900 days since that alleged LexisNexis controversy came to light, Angela Toomey.

In her RTK request, Toomey sought the County document or documents that tracks all Right to Know requests submitted through the Courthouse.

The County initially denied that request, claiming it was just a worksheet for a County employee, essentially, and not a public record. The state’s OOR upheld Toomey’s appeal and ordered the County to turn over the records she’s requesting.