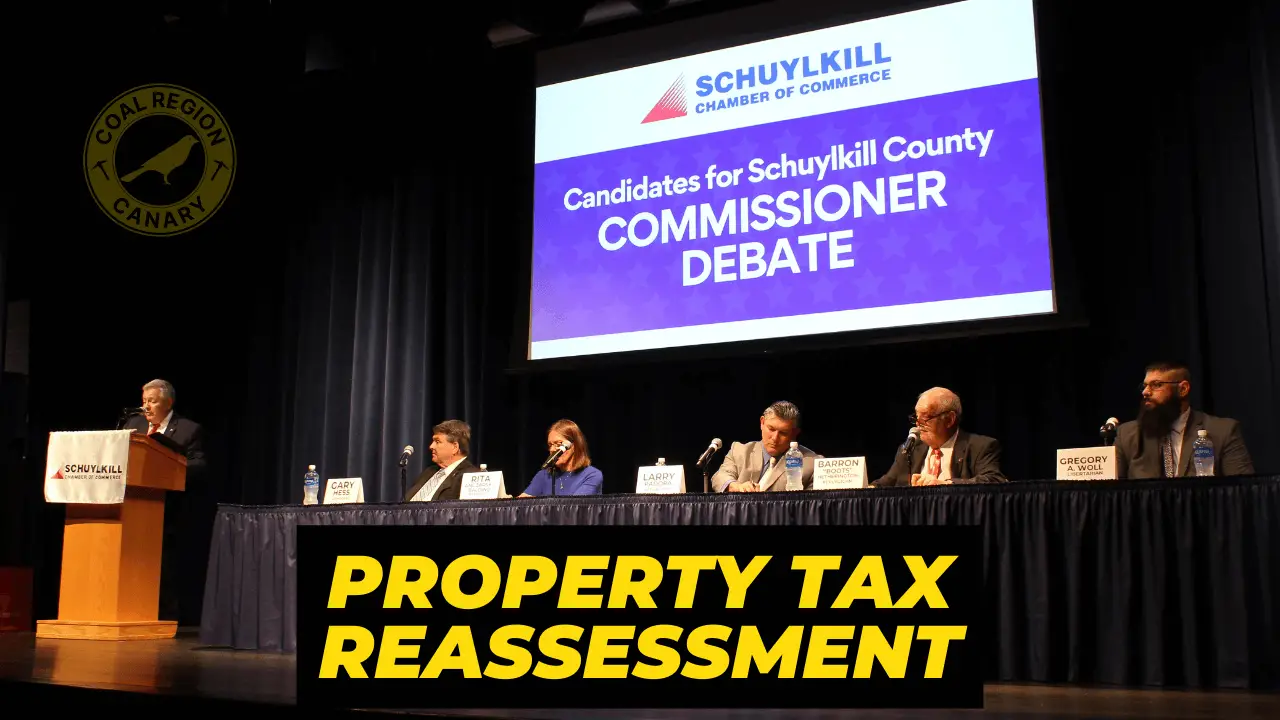

Tempers seem to have cooled a bit on the ongoing property tax reassessment happening here in Schuylkill County.

During the Primary season, you had candidates running for the Republican Party nomination who said they’ll fight it every inch of the way.

Now, closer to the General Election, you’re finding a simmering on that stance, almost an acceptance. In fact, at the recent Schuylkill County Commissioners candidate debate, some even suggested we do MORE property tax reassessments.

They provided reasons why that should be happening, too.

Schuylkill County Commissioners Debate: Property Tax Reassessment

Here’s how each of the candidate’s answered the question on property tax reassessment:

Woll: Reassessments Every 4-5 Years

Libertarian Greg Woll said something no one else really said on stage during the debate.

He believes there should be more property tax reassessments. Leaving this go for as long as it has is “a failure of the Commissioners and the (state) legislatures for the last 30 years.”

Now, while the prevailing opinion among those loudest about the ongoing reassessment is that it shouldn’t be happening at all, this take is certainly different.

Woll explained why he believes this.

“The smartest and most economic thing we can do is do one every 4-5 years. That would have kept the County on a consistent knowledge of where our properties are,” Woll said. “This would help new businesses coming into the area. They would have a better idea of what the properties looked like, that they want to purchase.”

That’s a reference to the current situation at the Schuylkill County Map Viewer tool. It is most likely to show viewers what the properties looked like in 1995, the last time Schuylkill County performed a property tax reassessment.

“Right now, if you go to look at property, it’s 1996 values and 1995 pictures,” Woll said. “You have no idea what you’re buying.”

He also said the County Commissioners should hold Vision Government Services to its word that one-third of properties will see a rise in taxes, one-third will see them fall, and the other third will see them hold steady. If not, he said we shouldn’t certify the results.

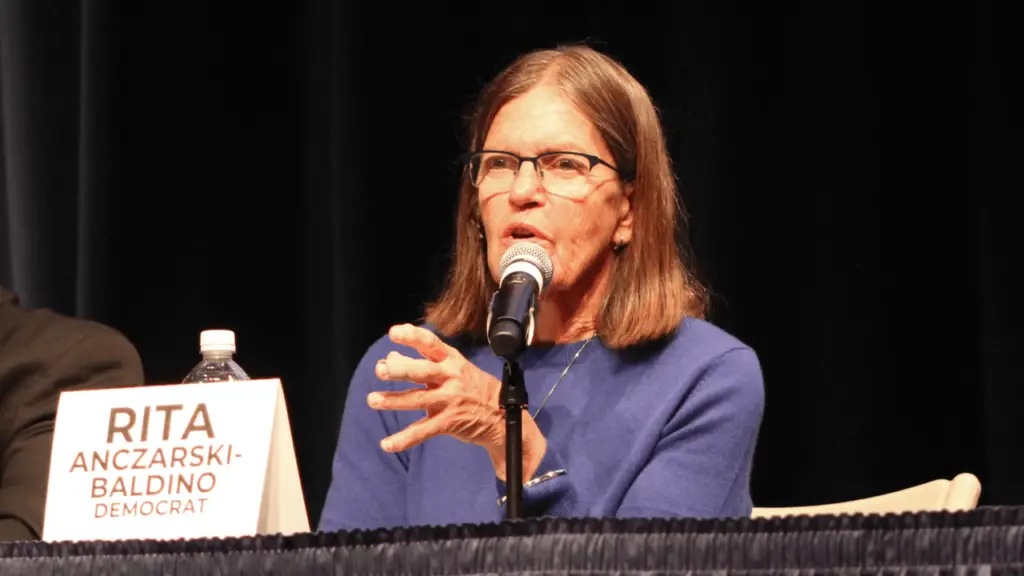

Anczarski-Baldino: Commissioners Failed to Make the Tough Decision on Reassessment for Years

Democrat candidate Anczarski-Baldino says she would have voted in favor of the reassessment, if she had been Commissioner at the time.

She, like Woll, said the Commissioners should have called for a reassessment sooner.

“This is a classic example of government pushing the can down the road and not making the tough decisions. I agree (with Woll), reassessment needs to occur in some kind of cyclical process,” she said.

She believes the current board of Commissioners made the right decision to go with Vision Government Solutions because their software solution, in the end, would allow the County to do future assessments (in 8-10 years, she said) more seamlessly.

“Should I be a seated Commissioner, I’d be leaving it in a better place for the next team to do a reassessment,” Anczarski-Baldino said. “No one likes taxes to go up, but I do think the seated Commissioners made the right decision. You can fight things for a period of time, but why put yourself in a position to have to fight in the first place? Just make the tough decisions that you’re elected to make.”

Padora: Make Sure Process is Transparent and Fair

Republican Larry Padora once said he would vote against certifying the reassessment but has since cooled his heels a bit on that stance taken before the Primary. He said at the debate, “The Commissioners agreed to settle a lawsuit, so the best thing we can do now is to make sure the process is transparent and is fair as possible to everybody in the county.

“I will never be a fan of it and I’ll be there at every step to make sure that it’s transparent and that people have a fair opportunity with this reassessment.”

Padora says he and fellow Republican candidate (and current Commissioner) Boots Hetherington have discussed the idea of an added step for anyone not happy with their informal appeal, should they take that step after getting the results of the reassessment on their property.

He wants to create an additional step in which taxpayers could have another appeal that includes an ombudsman from the County present at that stage.

Padora blamed state legislators for allowing a process that gives “3 people” the right to sue the County government that ended up forcing Schuylkill’s current reassessment.

“I think we have to take a long hard look at the legislation to advocate for a change in how this is done,” he said.

Hess: We Tried to Avoid Reassessment

Incumbent Democrat Gary Hess was one of two on stage during the debate (Hetherington) that actually voted to conduct the reassessment. He explained, as the Commissioners have since the process started, that their hands were essentially tied on the matter.

The County hired a consultant during the lawsuit that brought it on and was told they’d lose if they continued to fight in court.

Hess addressed criticism that Vision Government Services wasn’t properly scrutinized prior to the County hiring it to conduct the reassessment.

“They were absolutely vetted,” Hess said, indicating the County had assembled a task force before beginning the process. “There was about 6 people on that board. Three companies were vetted.”

The incumbent also defended the need for a reassessment. He explained that, as it stands, there’s an uneven playing field with property taxes. Hess said on the same street, “one guy is paying $1,000 and one guy is paying $500,” essentially on the same property value.

“What it does is bring fairness,” he said. “Absolutely, through the whole process, we’ll be sure it’s fair to everybody.”

Hetherington: Spot Reassessments Cause Unfair Tax Environment

Both Hess and Hetherington each said they didn’t “wake up one day” and decide the County needed to undergo a property tax reassessment.

He explained how the reassessment will affect him personally. Hetherington said he faces a “three-way whammy” because he owns a house, farm buildings, and farmland.

The incumbent Republican Hetherington placed a lot of the blame for the “unfair” taxes that Hess referenced on local school districts calling for “spot assessments” on properties.

“One of the big problems we have – and not to point fingers – our school districts with spot reassessments. Our townships don’t do that. Boroughs don’t do that. The County doesn’t do that,” he said. “Our job as Commissioners is to create fairness.”

Hetherington also put some blame on the state government, saying they need to look at some alternatives to the property tax, like with sales tax or income tax, to “take the burden off the homeowners.”

Watch the Debate

Here’s video of each candidate for Schuylkill County Commissioner answering the question on property tax reassessment in full:

Subscribe to Coal Region Canary

Get email updates from Coal Region Canary by becoming a subscriber today. Just enter your email address below to get started!Support Coal Region Canary

Like our reporting and want to support truly local news in Schuylkill County? Your small donations help. For as little as $5, your contribution will allow us to cover more news that directly affects you. Consider donating today by hitting the big yellow button below ...

PT Floridian

October 14, 2023 at 8:33 pm

They should have kept tax millage and property values up 20 years ago

…the hoardes of locusts have already arrived and our area has been stripped. Our towns are decimated with dirty, crumbling buildings, inner city lookalike housing, crime riddled streets and mental patients at every turn.

PT Floridian

October 16, 2023 at 9:28 am

If reassessment raises the burden for the residents here, where do they think that Seniors, fixed income folks, the droves of people on SSI and Disability and Welfare folks are going to get the money to satisfy those burdens ? Almost every young working family is cash strapped and both parents are working, with no possibility of saving anything, as the van loads of foreigners buy up delapidated properties all over the place and then disappear to NJ, NY and other nearby sanctuaries, while the properties rot and neighbors that care for their properties stew…

PT Floridian

October 16, 2023 at 9:44 am

It’s time (long overdue) for all the state representatives and politicians (bring security personnel) to take a comprehensive stroll through local towns like Mahanoy City, Shenandoah, Ashland and Frackville, and take a good long look at the deep, deep destruction and lawlessness that policies have done and will continue to do.

insider

October 16, 2023 at 11:00 am

People who treasure their homes,doing everything to upkeep their appearance, inside and out,will see the increases.. Many times these are senior citizens who have fixed incomes…Property taxes are inherently unfair…Pressure must be put on legislators to change the system…especially those who promise to do it during campaigns,and then after winning,go quietly into the night…and do nothing..

End Property Taxes Now

October 17, 2023 at 8:02 pm

Don’t believe for a minute that property tax reassessment is fair for everyone. I heard that 20 years ago. All it does is bring down the millage so that can tax it all up again.

These politicians are ridiculous. It’s all about spend spend spend .

PT Floridian

October 18, 2023 at 6:53 am

Everything is a money racket… everything.