Property owners in Schuylkill County are justifiably getting nervous as the final results of the ongoing tax reassessment will be known by the end of this year. And since the process began, one line has been repeated over and over regarding that end result:

About one-third of property owners will see a tax increase, about one-third will see a decrease, and about one-third won’t see much (or any) change at all.

During the recent public meetings on Schuylkill County’s property tax reassessment, Tim Barr of Vision Government Solutions, the company conducting the process here, illustrated that narrative with case studies from previous reassessments he’s done in other counties.

He also explained why some property owners can expect to see massive changes, good and bad, to their tax bills next year.

The reality is this: While many property owners won’t see those massive changes to their property tax bills next year, some definitely will. But Barr says those changes are necessary to balance the tax burden.

Case Studies: Blair and Tioga Counties

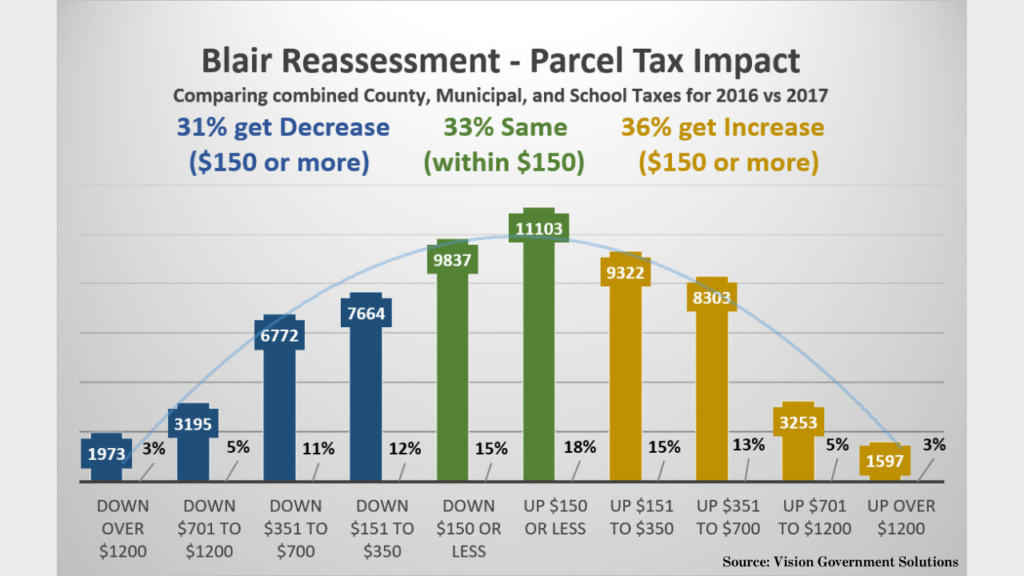

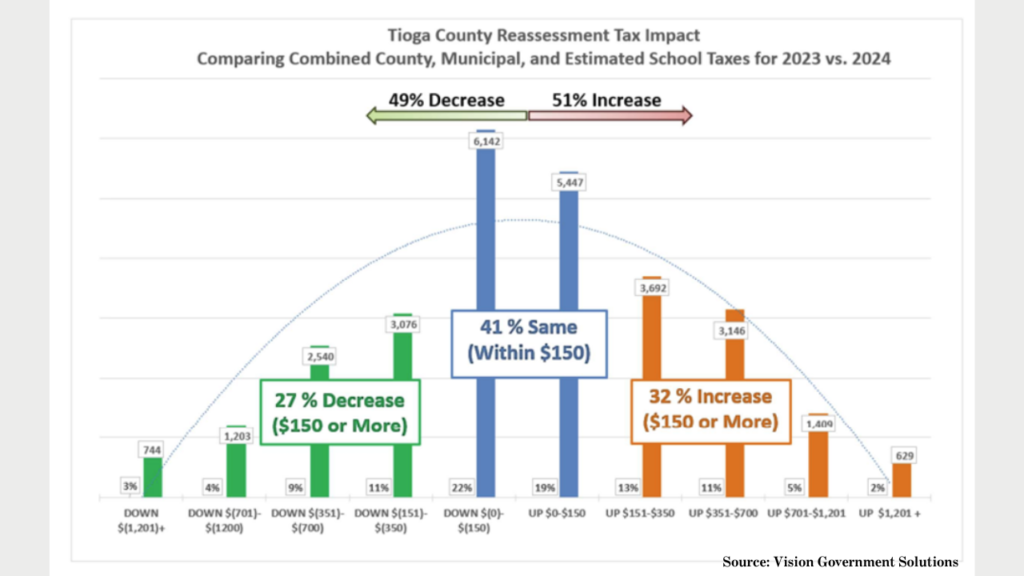

During the recent public meetings – held within five Schuylkill County school district territories – Barr showed examples from two Pennsylvania counties’ recent reassessments, Blair and Tioga.

Blair County property taxes were compared from 2016 and 2017 to show the old rates and the new. Barr said he used a $150 fluctuation in property taxes (combining county, school, and municipal) to denote a “significant” change in a property owner’s bill.

Based on the data he provided from that reassessment, 33% of property owners had their taxes stay mostly the same, meaning their bills didn’t go up or down by more than $150.

Another 36% of property owners saw a significant increase (more than $150). And 31% experienced a significant decrease.

The numbers were relatively similar in Tioga County. Barr used data from 2023 and 2024 to compare old and new tax bills there.

In Tioga County, after the reassessment, 41% of property owners had their tax bills largely unchanged. Meanwhile, 32% saw an increase of at least $151 and 27% had their bills decreased by $151 or more.

Massive Changes

Digging deeper into those numbers reveals that, yes, some property owners will see some truly significant changes – a lot more than $150 – to their tax bills next year in Schuylkill County.

Based on the two county examples Barr provided, 8% of property owners in Blair County saw their bills increase or decrease by $701 or more dollars. In fact, 3% of property owners saw bills go up or down by at least $1,201.

In Tioga County, that figure was 7% of property owners who saw a change, for better or worse, of more than $701 year over year. Among that group, 2% saw tax bills go up more than $1,200 after the reassessment. And 3% saw their bills go down by that much.

Barr: “We Need to Make It Right” After Years of Uneven Tax Burdens

Barr says the reason some property owners will see large fluctuations in their tax bills after a reassessment is simple: they haven’t been paying taxes based on the current value of their property. That’s because the last countywide reassessment in Schuylkill County was nearly 30 years ago, in 1996.

Since then, assessed values have failed to keep pace with rising market values. The county’s current Common Level Ratio Factor is 4.88, meaning the average property is selling for nearly five times its assessed value. At the time of the last reassessment, that ratio was closer to 2, indicating market values were about double the assessments then.

Barr says a reassessment is meant to restore fairness to the property tax system by ensuring everyone pays based on up-to-date values.

“I feel bad for the folks on the far end whose taxes went up by over $1,200,” Barr said. “But you know what, they needed to, because they were paying a fraction of what their property was worth. We need to make it right.”

To learn more about the reassessment process and a more thorough explanation of why there will likely be massive swings in property tax bills for some Schuylkill County owners next year, check out the presentation we recorded from Pine Grove Area High School on March 24:

MORE TO COME: We’ll have more reports on the next steps involved in the Schuylkill County Property Tax Reassessment and what options property owners have before new rates go into effect.

Subscribe to Coal Region Canary

Get email updates from Coal Region Canary by becoming a subscriber today. Just enter your email address below to get started!Support Coal Region Canary

Like our reporting and want to support truly local news in Schuylkill County? Your small donations help. For as little as $5, your contribution will allow us to cover more news that directly affects you. Consider donating today by hitting the big yellow button below ...

Fedupconseravtive

March 27, 2025 at 11:35 am

So Schuylkill County is going to penalize those who take care of their properties and worked hard their whole life to afford a nice house only to be penalized for it. Time for this to be eliminated and a flat tax for everyone.

FormerRELady

July 17, 2025 at 7:28 pm

What the Entire State Fails to take in with Real Estate taxes is That people buy a Home for what they can afford with the Income they have when they bought it.

that income changes from year to year. By the time many people are not making what they did in the prime o their life. Many have there home paid off- though now a days many do not.

So people are Penalized and taxed under the Assumption they can afford the Hiring Value the New reassessment is made Because it is based on The Younger Generation buying homes now so the prices go up.

It does not take into account Income of the person who lives there- what they paid for the home, how long they lived there. What it does is Drive the Elderly and those with Medium Incomes from their Homes.

This is not ! Like Governor Desnatis stated in Florida- You do not Tax a 401K that increases in value until the money is withdrawn. So why are you raising taxes on people when they have Not even sold their home?

That is the biggest problem with Pennsylvania.

FormerRELady

July 17, 2025 at 8:13 pm

I Apologize for my typos above. I meant Hire Value- Not Hiring value.

Also: This is Not (Equitable in any way)!

As a Former Real Estate Agent that is Retired. I can say those that are on Fixed incomes will fair worse. I am no exception. I pay near 10 thousand in Taxes- Do you think I can afford it to go to 20 thousand? NO!

I also will tell Everyone to Appeal your Taxes= Get 3 Comparables- same Year as yours Built- close to the same square footage, land size as well. These would be recent sales in your Town within the last 3 years.

Yes you will need to do leg work. Some people get reductions because they have a Raised Septic System and state they can not use that area. But land is not the high Taxed area- it is the House. Usually their is 5% taken off for depreciation for every year old the home is.But of course No home is going to be worth Zero. That is when you look at Recent Sale Values- That is your Comps.

Do not be afraid to go and appeal your taxes yourself- what will it do? They will say yes or no- Just do it. Make sure you know what Comps they used for your property(Ask for them before hand if you can – if not ask at your hearing) then have another hearing with your own Comps. Because I assure you- You know your Neighborhood better than this Company which is not even from the area.

I saw what they did with Tiogia which had low tax rates to start.Wellsboro was total 27.00 %. Now down to 13.00% (I rounded it) So they are half of what they were before but at the new 100% New House Value. That County has just a 3- 4 % County Tax. Before the Reassessment. So Tiogia and Schuylkill are Apples to Oranges!

By the Way- I really Do Believe people of Pa. Should do a Class Action Law Suit against the State to Stop Real Estate Taxes on Homes.

The State Makes Every County Report all Sales every year and give a Report on the Overall Taxed Percentage. This is used in deciding how much they get in State Money- Based on their Wealth or Poverty.

I agree with Flat Tax or Sales Tax.. And many Towns and Schools Tax your income so you are being Double Taxed. Not Fair.

Tod Cox

December 24, 2025 at 9:22 am

Everyone comments on your Facebook post but they don’t buy. You wanna know why? It’s because they’re there to watch cat videos and an algorithm showed them your ad simply because they may have been talking about your services to someone else around their phone or else they read or watched something related. It doesn’t mean they’re a “targeted” lead by no means. Now I’m messaging you on your contact form now because I know you’re a business owner who runs a website that needs more new clients. I mean who doesn’t need new clients? Even if you have too many now, don’t think they’re gonna stay with you forever – especially in today’s political climate where large contracts evaporate like water in the desert. I can put your ad in front of other like minded people who own websites just like you! Shoot me a reply now and I’ll gladly send over details and pricing.

Thanks for reading this and if you’re not interested then I am truly sorry to disturb you (but I would still love to show you how this can work for you!)

Warm Regards,

Phil Stewart

Canary Commenter

December 27, 2025 at 11:40 pm

“What you’ve just said is one of the most insanely idiotic things I have ever heard. At no point in your rambling, incoherent response were you even close to anything that could be considered a rational thought. Everyone in this room is now dumber for having listened to it. I award you no points, and may God have mercy on your soul.”